irs child tax credit 2021

The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify. The IRS has 45 days to process.

Should I Opt Of Child Tax Credit In 2021 11alive Com

Most people can get this money if.

. Here is everything you need to know about the child tax credit and other. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The deadline for filing your ANCHOR benefit application is December 30 2022. We will begin paying ANCHOR benefits in the late Spring of 2023. The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of.

And 3000 for children ages 6. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. 6419 from the IRS telling you how.

Two kids 15 and 17. 3600 for children ages 5 and under at the end of 2021. The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early.

Incentives depend on the HERS score and the classification. Turbo Tax calculated a 4k child tax credit and. This month Rhode Island families can similarly claim 250 per child and up to 750 for three children.

CTC Update 2023 is one of the most anticipated announcements by many families in the United States. Missing Advance Child Tax Credit Payment. Last year that maximum value increased to 3600 for children under age 6 and 3000.

ANCHOR payments will be. The amount of credit you receive is based on your income and the. The Child Tax Credit increased from 2000 to up to 3600 for each.

For 2022 the credit will be worth up to 2000 per. NJ Clean Energy- Residential New Construction Program. The American Rescue Plan in 2021 greatly expanded the federal Child Tax Credit along several dimensions.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each. For 2021 eligible parents or guardians can receive up to 3600 for each. This year the Child Tax Credit will revert back to the program offered by the IRS before the American Rescue Plan expanded it in 2021.

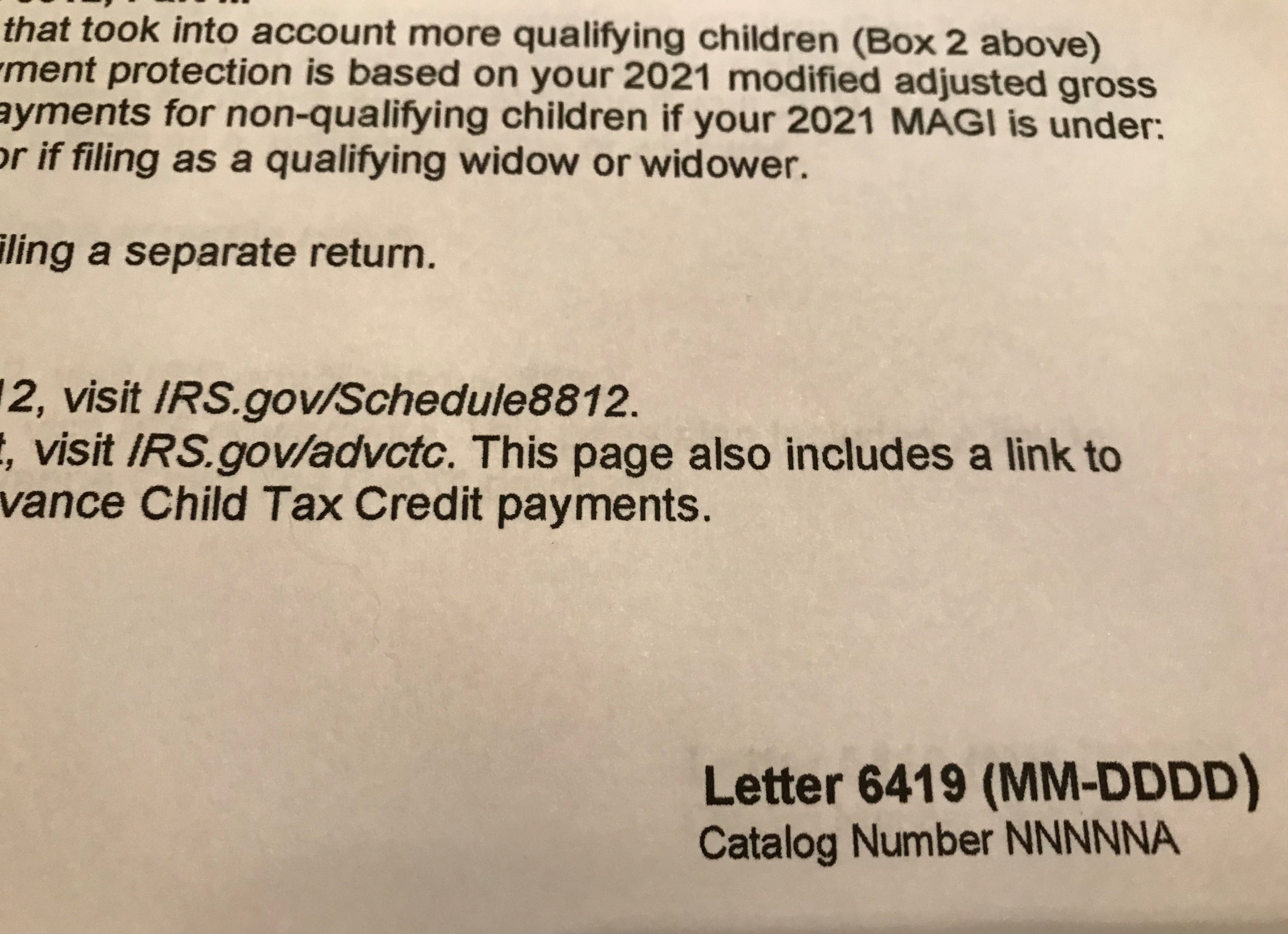

Very soon if you received advance payments of the Child Tax Credit you will be required to reconcile the payments received. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. You should receive a letter Letter No.

Is the Child Tax Credit for 2020 or 2021. The IRS processes returns with refunds due first because if the agency keeps you waiting too long it has to pay you your refund with interest. Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child.

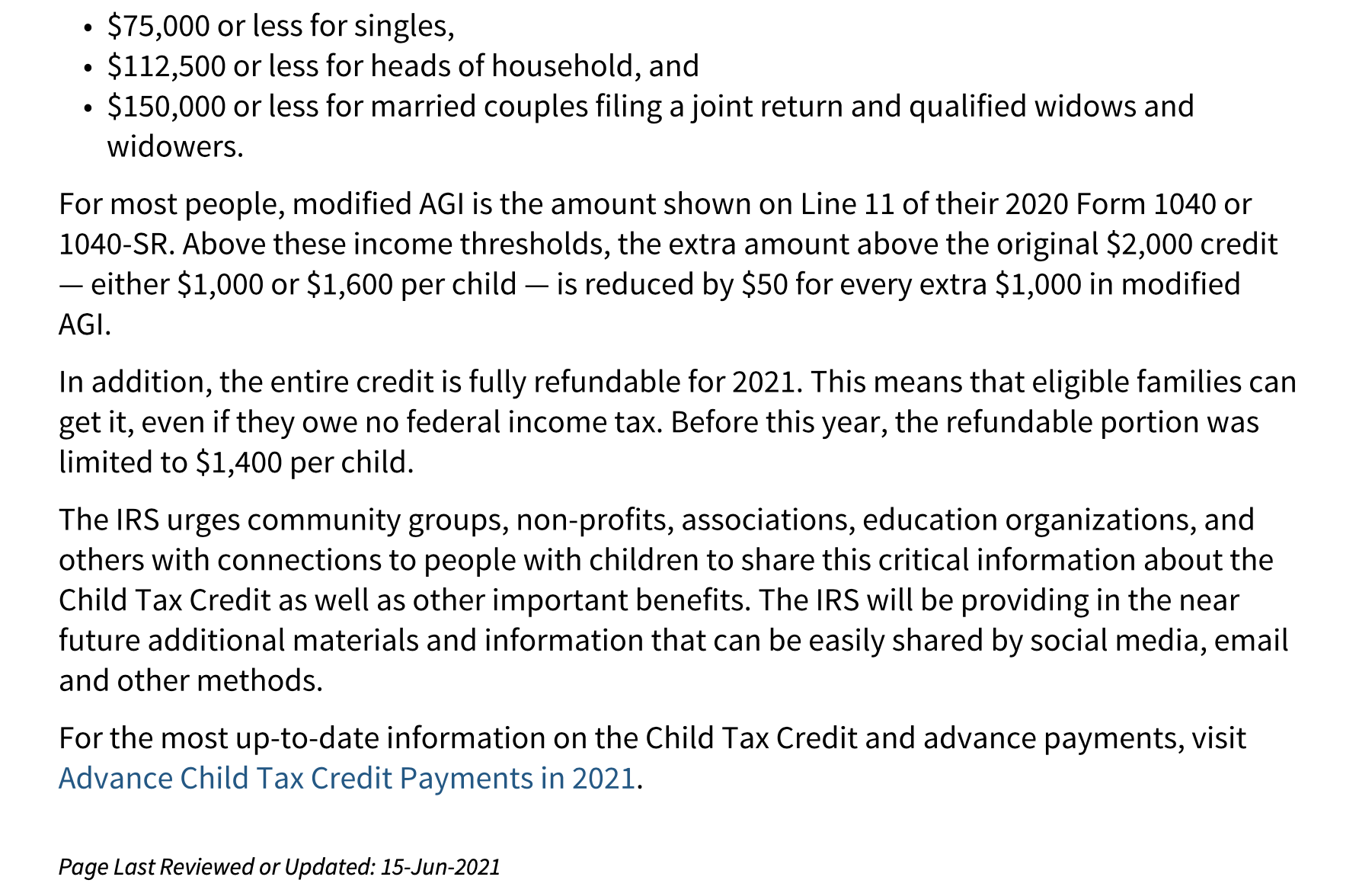

How to get your 2021 Child Tax Credit money even if you have no income. This credit has been included in the Current Population Survey. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

The Empire child tax credit in New York offers support to families with. Under the American Rescue Plan the Child Tax Credit was expanded in several ways for tax year 2021. You are eligible for a property tax deduction or a property tax credit only if.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Irs Sends Out Letters Child Tax Credit Payments And 2021 Taxes Wfmynews2 Com

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

Irs Sending Letters About Child Tax Credit

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Irs Sending Letters To More Than 36 Million Families Who May Qualify For Monthly Child Tax Credits Payments Started July 15 Children Youth News Coconino Coalition For Children Youth

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit What We Do Community Advocates

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

2021 Child Tax Credit The Nevada Registry

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit Updates What Time What If Amount Is Wrong

Irs Child Tax Credit Scam Arrives As Payouts Hit Bank Accounts

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Irs 2 New Online Tools Available To Help Manage Child Tax Credit Khou Com

Millions Of Families Received Irs Letters About The Child Tax Credit

What You Need To Know About Advanced Child Tax Credit Payments Jfs

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com